Over the last three months, the cryptocurrency industry has burst to life and many cryptocurrencies have experienced significant gains in this time.

However, despite the extreme interest in the market, there still remains significant entry barriers that make it challenging for everyday investors to gain exposure to cryptocurrencies and diversify their portfolio.

At the junction of this issue is the American multinational payment giant Visa, which provides the technology that underpins almost 1.2 billion Visa-powered debit and credit cards worldwide. Though these cards can be used in the great majority of retail and online stores, there is still a significant gap in the market for fiat-to-cryptocurrency purchases using Visa.

Barriers to Entry

When it comes to first entering the cryptocurrency industry, many investors are surprised to find that it is very difficult, if not impossible to buy most cryptocurrencies directly with their Visa credit or debit card.

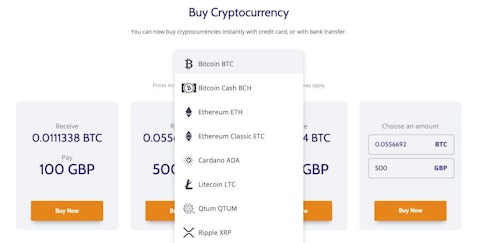

Visa card purchases are usually restricted to only the most popular cryptocurrencies. (Image: Coinmama)

Though it is possible to purchase most of the largest and most prominent cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) from most cryptocurrency brokers using Visa payment methods, customers looking to purchase less popular altcoins will usually be faced with a complicated and expensive multi-step process.

This usually involves first buying a supported cryptocurrency (fee #1), transferring it to an exchange platform (fee #2), and then trading this (fee #3) for the cryptocurrency the customer actually wants. As you might imagine, this process is overly complicated — particularly for first first-time investors — and can be a significant barrier to entry.

Since Visa is the world’s largest electronic payment network and is used by over 1 billion individuals, it stands to reason that an efficient bridge between Visa payments and cryptocurrency purchases would knock down one of the biggest barriers to entry for retail investors.

A New Wave of Adoption

As it stands, the most common way people purchase cryptocurrencies using their Visa card is through a brokerage like Coinbase or Coinmama. But as we previously touched on, these platforms often lack support for newer cryptocurrencies and most altcoins, leaving investors unable to easily invest in their favorite altcoins.

To address this, a wide variety of crypto projects have now begun directly incorporating Visa as a payment method in recent weeks, helping to make purchases of blockchain services and cryptocurrency even more accessible — and bypassing the need for brokers.

Among these, the popular cryptocurrency trading education and market analytics platform NewsCrypto is the most recent. With the addition of Visa support, NewsCrypto users can now purchase NewsCrypto Coin (NWC) tokens using their Visa debit or credit card.

These NWC tokens can then be used to pay for premium membership on the platform or can be held for speculative purposes, since the digital asset has appreciated by almost 170% in 2020 alone.

Beyond this, a number of other prominent cryptocurrencies have also recently been opened for Visa card purchases, including Elrond (ERD) through Binance’s recently acquired Swipe app, and COTI through the ChangeNOW fiat gateway.

Visa’s Recent Moves

Visa’s involvement with the cryptocurrency industry could be considered tentative in the early days of the industry. However, Visa appears to have changed its stance in recent years, and is now actively forming partnerships and arrangements with a number of blockchain projects.

https://twitter.com/VisaNews/status/1182777021488881664

Back in 2019, Facebook announced that Visa would form part of the Libra Association — a group of high profile organizations tasked with overseeing major decisions about the upcoming Libra cryptocurrency. However, the payment giant pulled out of the association in October the same year — likely due to the regulatory challenges the project faced at the time.

Since then, Visa has slowly ramped up its presence in the cryptocurrency industry, after making Coinbase a principal member back in February, ramping up its exploration of the science of blockchain technology, and recently announcing plans to advance its approach to digital currency.

If a recently published patent is anything to gauge Visa’s intentions by, then it might not be long before we see the launch of a Visa-backed “private permissioned distributed ledger platform,” through which Visa users may be able to purchase cryptocurrencies without relying on any third-party platforms.